Multi-currency virtual currency savings solution

(Abu Dhabi law applies)

Users can deposit BTC, ETH, DOGE, and USDT and choose different periods to obtain stable income. Interest is paid in USDT, and the principal is returned in full in the original currency after the storage period expires, ensuring the flexibility and security of user assets. This solution complies with the regulations of the Abu Dhabi Global Market (ADGM) and the UAE Virtual Asset Regulatory Authority (VARA) to ensure compliant operations.

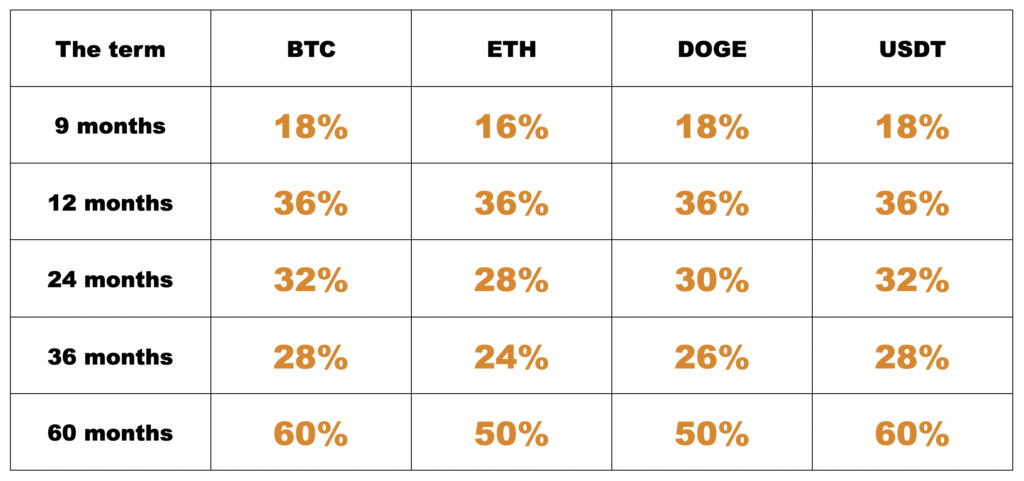

Supported currencies & annualized rate of return

Interest is paid in USDT and the principal is returned in the original currency.

Tip: If investors withdraw funds in advance, interest will be calculated based on the actual number of days saved and an annualized interest rate of 2%.